North American Continuous Glucose Monitoring Devices Market Size 2018

Report Overview

The global continuous glucose monitoring device market size was valued at USD 4.7 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 10.1% from 2021 to 2028. Key factors driving this market are the rising incidence of diabetes, coupled with the increasing geriatric population prone to diabetes. The Continuous Glucose Monitoring (CGM) devices market is further propelled by growing awareness about diabetes preventive care, new product launches, and supportive government initiatives. Increased demand for continuous glucose monitoring devices amid the COVID-19 pandemic is attributed to the loosened restricted regulations and issued guidelines for the use of home-use glucose meters or CGMs in hospital settings by the federal agencies. The CGMs approved for hospital use include the Dexcom G6 and Abbott FreeStyle Libre.

This was mainly done to ensure the safety of healthcare workers and self-testing among the patients. The American Diabetic Association also issued several resources on COVID-19 and diabetes. Delayed diagnosis due to lockdown restrictions and low awareness among several developing countries are likely to hamper the adoption of these devices. According to the survey conducted by Novartis AG, only 7% of individuals visit doctors at an early or pre-diabetic stage, leaving a staggering 93% with already developed type 2 diabetes. A rise in the incidence of diabetes due to aging, obesity, and an unhealthy lifestyle is one of the factors contributing to the growth of the market.

COVID19 impact: High usage in isolated patients. The market increased by 18% in 2020 from 2019

| Pandemic Impact | Post COVID Outlook |

| Due to the need for remote monitoring of COVID-19 patients, the CGM has shown sudden demand growth during COVID-19 | Studies suggest that the average time-in-range of the CGM users increased faster during the pandemic. The trends are expected to significantly impact the adoption of CGM in upcoming years. |

| The demand for continuous monitoring of COVID-19 patients, in both, hospital and home settings was significant during the pandemic. | As COVID-19 recovered diabetes patients develop resistance to insulin, the traditional injections fail to provide proper management. CGM can replace the need for frequent sugar level checks. |

Obesity is a major factor leading to diabetes. According to WHO, in 2016, over 1.9 billion adults were overweight, of which, around 650 million people were obese. These devices allow the observation of blood glucose at various time intervals with the help of a sensor and these readings are transmitted over a wireless network. Respective readings are fed into diabetes management software to allow the patient to understand the disease better, in turn, helping them to manage it better.

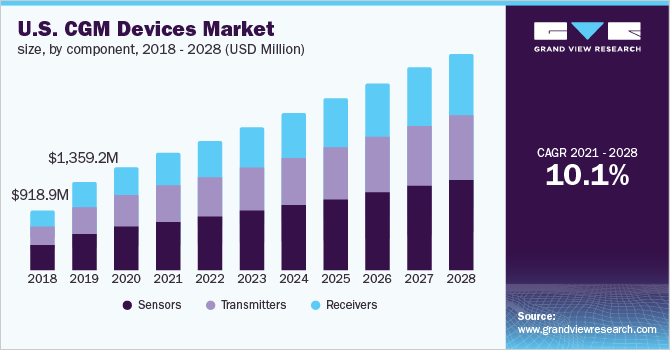

Component Insights

Based on their components, CGM devices are segmented into three broad categories namely sensors, transmitters, and receivers. The sensors segment led the market accounting for the maximum revenue share of over 39% in 2020. The segment is also expected to register the fastest CAGR of 10.0% from 2021 to 2028. Sensors are the most sophisticated part of CGM devices and consist of a metallic filament, thinner than a needle, which is inserted into the fatty layer just below the skin. The technology used in sensors is slightly different than the one used in transmitters and receivers. These components use glucose oxidase to detect blood sugar levels.

Glucose oxidase converts glucose to hydrogen peroxidase, which reacts with the platinum inside the sensor, producing an electrical signal to be communicated to the transmitter. A transmitter works along with the receiver to collect the readings from the sensor and displays the results on the device monitor. A battery-powered, hand-held receiver that displays the results receives signals from the transmitter. The receiver also displays various graphs and statistics that can be used for the customization of medication, which is helpful for individuals suffering from hyperglycemic or hypoglycemic conditions.

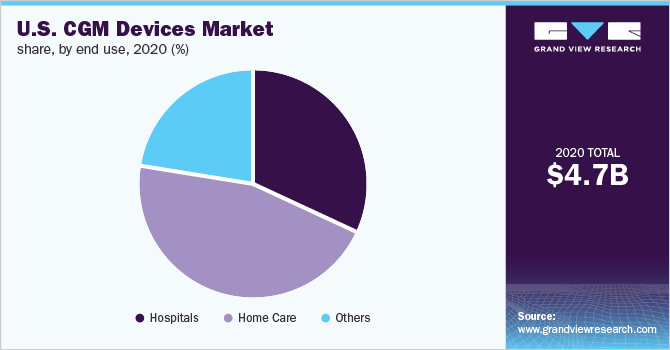

End-use Insights

The home care segment led the global market accounting for a revenue share of more than 43% in 2020. The segment will expand further at the fastest CAGR during the forecast years. Based on end-use, the market is segmented into hospitals, home care, and others. The hospital segment is expected to grow at the second-highest CAGR of over 9.5% from 2021 to 2028. Factors driving this growth include increased usage of CGM devices in hospitals and healthcare settings for the identification of blood sugar levels in patients suffering from diabetes mellitus.

CGM devices perform considerably better compared to Self-monitoring Blood Glucose (SMBG) devices during clinical studies involving gestational diabetes mellitus, according to the National Center for Biotechnology Information. In addition, the introduction of technologically advanced devices for the management of diabetes mellitus will further augment product adoption in the hospital end-use segment.

Regional Insights

North America was the dominant regional market in 2020 and accounted for a revenue share of over 39%. The regional market will expand further at a steady CAGR from 2021 to 2028 retaining its leading industry position owing to the presence of a well-established healthcare sector in the region. The increasing prevalence of obesity, the presence of efficient reimbursement policies, and growing awareness about advanced technologies in diabetes management are also expected to drive the regional market.

On the other hand, Asia Pacific is estimated to be the fastest-growing regional market from 2021 to 2028. The number of diabetic patients is rising in the Asia Pacific region in comparison to other parts of the world. According to the International Diabetes Federation, India and China account for the largest number of diabetic patients in the world. The increase in obesity cases and growing socio-economic changes have fueled the occurrence of type I and type II diabetes.

Key Companies & Market Share Insights

The market has the strong presence of a large number of global and regional companies. Most of the leading companies are involved in strategic collaborations, product developments, mergers, and acquisitions, and regional expansions to gain a higher revenue share in the industry.

For instance, in November 2020, Medtronic announced FDA approval for its smart insulin pen called "InPen", indicated for diabetic patients on multiple daily injections. The device comes with a Guardian CGM system, which enables real-time access to patients' glucose and insulin data. Some of the key players in the global continuous glucose monitoring devices market are:

-

Medtronic

-

Dexcom, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Abbott

-

Novo Nordisk A/S

-

Ypsomed

-

GlySens, Inc.

Continuous Glucose Monitoring Device Market Report Scope

| Report Attribute | Details |

| Market size value in 2021 | USD 5.28 billion |

| Revenue forecast in 2028 | USD 10.36 billion |

| Growth Rate | CAGR of 10.1% from 2021 to 2028 |

| Base year for estimation | 2020 |

| Historical data | 2016 - 2019 |

| Forecast period | 2021 - 2028 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2021 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Component, end use, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; U.K.; China; India; Brazil; Mexico; South Africa; Saudi Arabia |

| Key companies profiled | Medtronic; Dexcom, Inc.; F. Hoffmann-La Roche Ltd.; Abbott; Novo Nordisk A/S; Ypsomed; GlySens, Inc. |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global continuous glucose monitoring device market report on the basis of component, end use, and region:

-

Component Outlook (Revenue, USD Million, 2016 - 2028)

-

Transmitters

-

Sensors

-

Receivers

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Home Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global CGM devices market size was estimated at USD 4.7 billion in 2020 and is expected to reach USD 5.28 billion in 2021.

b. The global CGM devices market is expected to grow at a compound annual growth rate of 10.1% from 2020 to 2028 to reach USD 10.36 billion by 2028.

b. North America dominated the global CGM devices market with a share of 39.3% in 2020. This is attributable to increasing cases of diabetes and efforts taken by the national government to manage the disease.

b. Some key players operating in the CGM devices market include Pfizer Inc.; Baxter International Inc.; Abbott Laboratories; Medtronic, Inc.; Animas Corporation; Novo Nordisk; Ypsomed; and GlySens.

b. Key factors that are driving the market growth include growing cases of diabetes, coupled with the increasing adoption of continuous glucose monitoring (CGM) devices.

Source: https://www.grandviewresearch.com/industry-analysis/continuous-glucose-monitoring-market

Komentar

Posting Komentar